-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

-

Разработчики

Personal Gadget Insurance Market Booms Amid Rising Smartphone and Electronics Ownership

"Executive Summary Personal Gadget Insurance Market :

CAGR Value

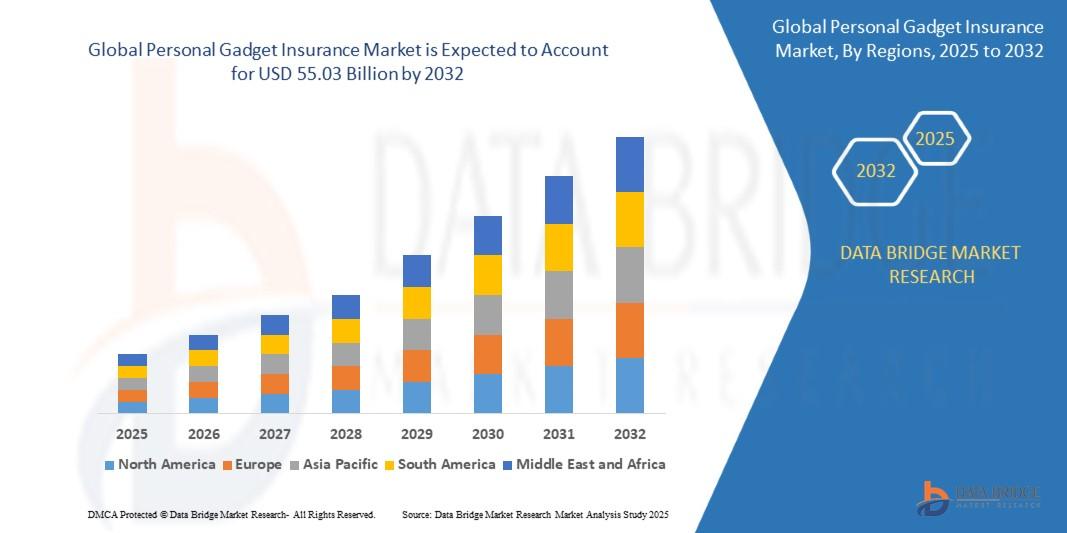

The global personal gadget insurance market size was valued at USD 25.30 billion in 2024 and is projected to reach USD 55.03 billion by 2032, with a CAGR of 10.20% during the forecast period of 2025 to 2032.

The key highlights of this Personal Gadget Insurance Market report are key market dynamics, current market scenario and future prospects of the sector. By understanding and keeping into focus customer requirement, one method or combination of many steps have been applied to build the most excellent market research report. Whereas market definition covered in this Personal Gadget Insurance Market report explores the market drivers which indicate the factors causing rise in the market growth and market restraints which indicate the factors causing fall in the market growth. It helps customers or other market participants to be aware of the problems they may face while operating in this market over a longer period of time.

A team of skilled analysts, statisticians, research experts, enthusiastic forecasters, and economists work painstakingly to structure such a great market research report for the businesses seeking a potential growth. This team is focused on understanding client’s businesses and its needs so that the finest market research report is delivered to the client. This market research report encompasses a comprehensive study of the product specifications, revenue, cost, price, gross capacity and production. With the use of up to date and proven tools and techniques, complex market insights are organized in simpler version in this Personal Gadget Insurance Market report for the better understanding of end user.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Personal Gadget Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market

Personal Gadget Insurance Market Overview

**Segments**

- **Type**: The personal gadget insurance market is segmented based on type into theft and loss insurance, accidental damage insurance, extended warranty, and others. Theft and loss insurance cover the expenses in case of theft or loss of the insured gadget. Accidental damage insurance provides coverage for damages caused by accidents. Extended warranty extends the manufacturer's warranty period, offering protection against defects or malfunctions beyond the initial warranty period. Other types of insurance can include coverage for mechanical breakdowns, liquid damage, and more.

- **Distribution Channel**: The market is segmented by distribution channel into direct sales and distribution. Direct sales refer to insurance policies purchased directly from the insurance company. Distribution channels involve the sale of insurance policies through intermediaries such as agents, brokers, and online platforms. Each channel offers different levels of convenience and personalization to cater to the diverse needs of consumers.

- **End-User**: The personal gadget insurance market is further segmented by end-user into individuals and businesses. Individuals purchase insurance to protect their personal electronic devices such as smartphones, laptops, tablets, and cameras. Businesses acquire insurance to cover gadgets used for commercial purposes, including office equipment, POS systems, and specialized devices for various industries.

**Market Players**

- **Allianz Insurance**

- **American International Group, Inc.**

- **Assurant**

- **Asurion**

- **Aviva**

- **Brightstar Corp.**

- **N. Life Insurance Company Ltd**

- **Xponential Inc (trade as Trov)**

- **Worth Ave. Group**

These market players are actively involved in offering personal gadget insurance solutions to consumers and businesses globally. They provide a range of insurance products tailored to meet different coverage needs and preferences, leveraging advanced technologies and innovative strategies to enhance customer experience and satisfaction.

The personal gadget insurance market continues to witness significant growth due to the increasing adoption of smartphones, laptops, and other electronic devices globally. One key trend shaping the market is the rising awareness among consumers regarding the need for comprehensive insurance coverage to safeguard their expensive gadgets from various risks such as theft, accidental damage, and malfunctions. Market players are focusing on expanding their product portfolios to cater to the evolving needs of consumers, offering flexible and customizable insurance plans to meet individual preferences.

Moreover, the growing demand for seamless and hassle-free insurance services is driving the market towards digital transformation. Insurers are leveraging digital technologies such as mobile apps, online platforms, and AI-powered tools to enhance customer engagement, streamline the claims process, and provide real-time assistance to policyholders. This shift towards digitalization is not only improving operational efficiency for insurance companies but also enhancing the overall customer experience, thereby fostering customer loyalty and retention.

Another significant factor influencing the market dynamics is the increasing collaboration between insurance providers and gadget manufacturers or retailers. Partnerships and strategic alliances enable insurers to reach a wider customer base through retail channels and offer bundled insurance solutions at the point of sale. This integrated approach not only simplifies the insurance purchase process for consumers but also ensures higher policy penetration rates, as customers are more likely to opt for insurance coverage when buying a new gadget.

Furthermore, the personal gadget insurance market is witnessing a surge in demand for specialized insurance products tailored for specific devices or usage scenarios. Insurers are introducing niche insurance plans for high-end smartphones, drones, wearable devices, and other gadgets with unique features and functionality. These tailored insurance solutions address the specific risks associated with different types of gadgets, providing consumers with comprehensive protection and peace of mind.

In conclusion, the personal gadget insurance market is poised for continued growth and innovation, driven by evolving consumer preferences, digital advancements, strategic partnerships, and specialized insurance offerings. Market players need to stay abreast of these trends and developments to capitalize on emerging opportunities and differentiate themselves in a competitive landscape. By focusing on customer-centric strategies, technological innovation, and product diversification, insurers can effectively address the changing needs of consumers and maximize their market presence in the evolving digital insurance ecosystem.The personal gadget insurance market is a dynamic and evolving sector driven by the increasing reliance on electronic devices in both personal and commercial settings. With the escalation in smartphone, laptop, and other gadget usage worldwide, the demand for comprehensive insurance coverage has surged significantly. Consumers are becoming more aware of the risks associated with their valuable gadgets, prompting a shift towards seeking protection against theft, damage, and technical malfunctions. This trend is reshaping the market landscape, with insurance companies adapting by offering a diverse range of insurance products tailored to meet the varied needs and preferences of consumers.

One of the key trends shaping the personal gadget insurance market is the rapid digital transformation within the industry. Insurers are leveraging cutting-edge technologies such as mobile applications, online platforms, and artificial intelligence tools to enhance customer engagement and streamline insurance processes. By embracing digital initiatives, insurance providers are not only improving operational efficiency but also enhancing the overall customer experience. The emphasis on seamless, hassle-free services is driving insurers to innovate and optimize their digital capabilities to cater to tech-savvy consumers who seek convenience and instant access to insurance solutions.

Moreover, the market is witnessing an uptrend in collaborations between insurance companies and gadget manufacturers or retailers. These partnerships enable insurers to expand their reach through retail channels and offer bundled insurance solutions at the point of sale. By joining forces with tech companies, insurers can deliver integrated insurance options to consumers at the time of gadget purchase, simplifying the decision-making process and enhancing customer value propositions. This collaborative approach not only benefits consumers by providing a one-stop solution but also facilitates increased awareness and adoption of insurance services among gadget owners.

Furthermore, the rise of niche insurance products tailored for specific devices or usage scenarios is another notable trend in the personal gadget insurance market. Insurers are introducing specialized insurance plans for high-end gadgets like smartphones, drones, and wearables, catering to the unique needs and risks associated with these devices. By offering customized insurance solutions, insurers can address the specific concerns of gadget owners and provide comprehensive protection against unforeseen events. This trend reflects a growing consumer preference for tailored insurance coverage that aligns with their individual gadget usage and risk profiles.

In conclusion, the personal gadget insurance market is evolving rapidly, driven by consumer awareness, digital advancements, strategic partnerships, and specialized insurance offerings. Insurers that prioritize customer-centric approaches, technological innovation, and product diversification will be better positioned to capitalize on emerging opportunities and differentiate themselves in a competitive market environment. By staying abreast of market trends and leveraging innovative strategies, insurance providers can meet the evolving needs of consumers and establish a strong foothold in the dynamic landscape of personal gadget insurance.

The Personal Gadget Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

- This study presents the analytical depiction of the global Personal Gadget Insurance Market Industry along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Personal Gadget Insurance Market

- The current market is quantitatively analyzed to highlight the Personal Gadget Insurance Market growth scenario.

- Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

- The report provides a detailed global Personal Gadget Insurance Market analysis based on competitive intensity and how the competition will take shape in coming years.

Browse More Reports:

Global Natural Fiber-reinforced Plastics (NFRP) Market

Global Pharmaceutical Grade Lactose Market

Global Sideroblastic Anemia Market

Global Low Global Warming Potential (GWP) Refrigerants Market

Global Smudge Resistant Coating Market

Global Sodium Silicate Market

Global Personal Cloud Storage Market

Middle East and Africa Kickboxing Equipment Market

Latin America Radiology Services Market

Global Sodium Lignosulfonate Market

Global Micro Flute Paper Market

Middle East and Africa Tomatoes Market

Global Blood Coagulation Analyzer Market

Global Sugar Substitutes for Food Applications Market

Global Digital Imaging Market

Global Structural Insulated Panel Market

Global Manned Guarding Market

Global Neuroendocrine Tumors Market

Global Therapeutic Radiopharmaceuticals Market

Global Breast Cancer 1 (BRCA1) and Breast Cancer 2 (BRCA2) Genes Market

Global Monochrome Cathode Rays Tube (CRT) Market

Global Acute Renal Failure (ARF) Market

Asia-Pacific Smart Hospital Market

North America Pharmacogenetics Testing in Psychiatry/Depression Market

Global Data Center Infrastructure Management Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"

- Seo

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Business & Money