10 Tolas Gold Price: A Comprehensive Guide for Investors

Gold has always been a symbol of wealth and security, making it a preferred investment choice for individuals and institutions alike. Among the various gold bar sizes available, the 10 tolas gold price is a popular option for serious investors seeking a balance between affordability and value. In this article, we explore the factors influencing the 10 tolas gold price, its investment benefits, and how to purchase one securely.

Factors Influencing 10 Tolas Gold Price

The price of a 10 tolas gold bar is determined by several key factors:

-

Gold Market Price – The primary determinant of gold bar prices is the global gold spot price, which fluctuates based on supply and demand, economic conditions, and geopolitical events.

-

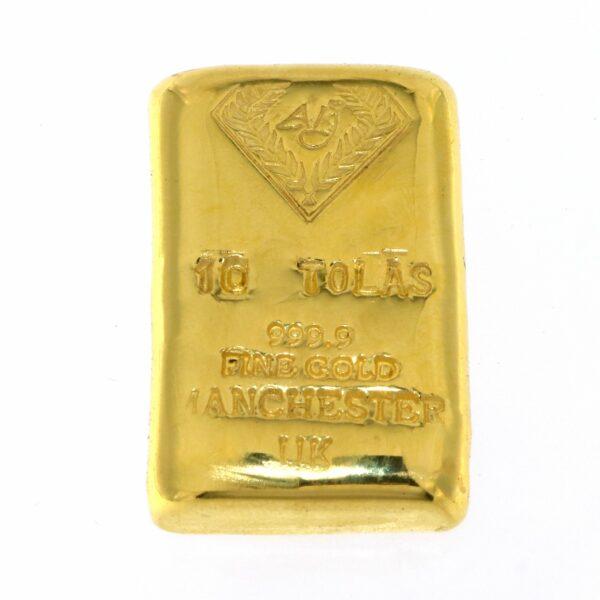

Purity and Certification – Most 10 tolas gold bars come with a purity level of 999.9 fine gold, ensuring they contain high-quality gold. Reputable refineries such as PAMP, Valcambi, and Heraeus certify their bars, which can slightly impact pricing.

-

Manufacturer and Brand – Renowned mints and refineries charge a premium due to their reputation and guaranteed authenticity.

-

Supply and Demand – During periods of economic instability, demand for gold increases, causing prices to rise.

-

Dealer Premiums and Taxes – Buyers should also consider dealer premiums, VAT, and import duties that might affect the final purchase price.

Current 10 Tolas Gold Price

As of today, the 10 tolas gold price varies based on the global gold rate. To get the most up-to-date pricing, it is recommended to check with reputable gold dealers, financial news websites, or authorized bullion retailers.

On average, a 10 tolas gold bar price is calculated as:

(Gold Spot Price per Gram × 116.64) + Dealer Premium + Taxes

For example, if the gold price is £50 per gram, the base price of a 10 tolas gold bar would be £5,832, excluding additional costs.

Where to Buy a 10 Tolas Gold Bar?

Investors looking to buy a 10 tolas gold bar should consider the following options:

-

Authorized Bullion Dealers – Trusted dealers offer certified and authenticated gold bars with purity guarantees.

-

Online Marketplaces – Websites like the Royal Mint, BullionVault, and GoldCore provide easy access to gold bars with delivery or storage options.

-

Banks and Financial Institutions – Some banks offer direct gold purchases with secure storage services.

-

Local Gold Retailers – Physical stores allow buyers to inspect gold bars before purchase but may have higher premiums.

Benefits of Investing in a 10 Tolas Gold Bar

-

Hedge Against Inflation – Gold retains value over time, making it an excellent store of wealth.

-

Portfolio Diversification – Holding physical gold reduces investment risks.

-

Easy Liquidity – A 10 tolas gold bar is easily tradable and 10 tolas gold price can be sold in global markets.

-

Lower Premiums – Compared to smaller bars, a 10 tolas gold bar often has lower per-gram premiums.

Final Thoughts

Investing in a 10 tolas gold bar is a strategic move for those looking to preserve and grow their wealth. Always ensure that you buy from reputable sources, verify authenticity, and check current market rates before making a purchase. Stay informed about price trends to maximize returns on your gold investment.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Script

- App