Clean Beauty & Tech Innovation: Shaping the Future of Skin Care Products

MARKET OVERVIEW

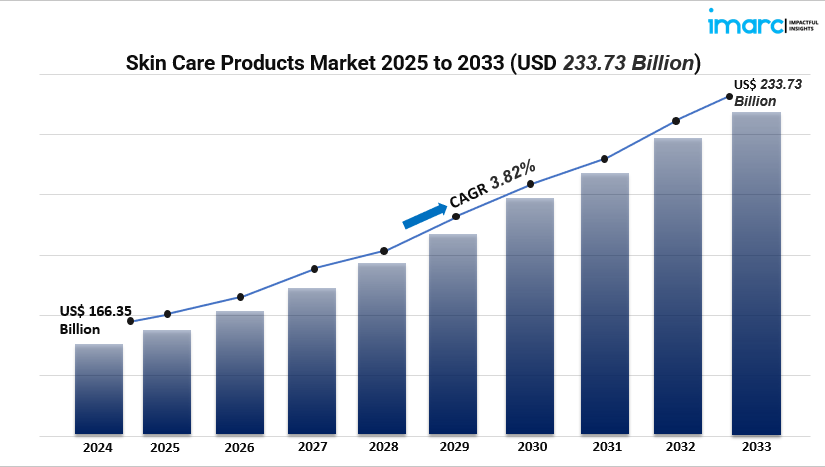

The global skin care products market hit USD 166.35 billion in 2024 and is anticipated to grow to USD 233.73 billion by 2033, with a CAGR of 3.82% . This surge is fueled by rising consumer awareness of skin health, the shift toward natural and organic formulas, rapid technology-driven product innovation, and booming e-commerce channels. Aging demographics, urban lifestyles, and social media influence further reinforce sustained demand.

STUDY ASSUMPTION YEARS:

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019

- FORECAST YEAR: 2033

Skin Care Products Market Key Takeaways

- Market Size and Growth: Valued at USD 166.35 billion (2024), forecast to reach USD 233.73 billion by 2033 at a 3.82% CAGR.

- Regional Leader: Asia‑Pacific dominates with over 39.8% market share in 2024.

- Product & Ingredient Trends: Strong demand for natural, plant-based, and clean-label products, especially in anti-aging and sun protection.

- Distribution Shift: Rapid expansion of e‑commerce—U.S. online skin-care sales projected to exceed USD 10 billion by 2027.

- Demographic Drivers: Aging population and increased awareness of skin damage by pollution and UV exposure.

- Tech & Innovation: Adoption of biotech in formulations, AI-driven personalization, and advanced delivery systems.

MARKET GROWTH FACTORS

1. Rising Consumer Awareness & Clean‑Beauty Demand

The e-commerce boom is really shaking up the skincare market, especially in developed countries. In fact, U.S. online skincare sales are expected to exceed a whopping USD 10 billion by 2027, all thanks to the convenience and wide variety available online. Social media influencers and beauty experts play a huge role in boosting the visibility and popularity of new products, particularly among younger shoppers. Platforms like Instagram and TikTok are hotbeds for viral trends, like K-beauty routines, which often lead to real sales. This digital-first approach allows for quicker product launches and gives niche, direct-to-consumer brands a chance to thrive in a crowded market.

2. Technological Advancements & Product Innovation

When it comes to the skincare scene, Asia-Pacific is leading the charge with about 39.8% market share projected for 2024. This growth is fueled by urbanization, increasing disposable incomes, a growing awareness of beauty, and a strong embrace of e-commerce. The rapid expansion of the middle class in countries like China, India, and South Korea is driving a high demand for anti-aging products, sun protection, and clean-label options, all influenced by tech-savvy consumers and digital trendsetters.

3. E‑commerce Expansion & Social Media Influence

Innovations are truly transforming the skincare industry. For instance, Pond’s Skin Institute rolled out an in-store microbiome analysis tool in mid-2024, allowing for personalized skincare regimens in just 60 minutes. Major brands are also stepping up with biotech-enhanced delivery systems and plant-based cleansers. The rise of AI-driven diagnostics and virtual shopping tools is giving consumers the power to receive tailored product recommendations. Meanwhile, the clean-beauty movement continues to gain momentum, with more and more chemical-free, eco-friendly product lines hitting the shelves to satisfy the growing demand for transparency and sustainability.

Request for a sample copy of this report: https://www.imarcgroup.com/skin-care-products-market/requestsample

MARKET SEGMENTATION

Segmentation by Product Type:

- Face Creams: Moisturizers designed for facial hydration, anti-aging, and complexion improvement.

- Sunscreen: Products offering UV protection to prevent sun damage and photo-aging.

- Body Lotion: Lotions aimed at whole-body skin hydration and barrier maintenance.

- Other Skin Care Products: Includes masks, cleansers, serums addressing various skin concerns.

Segmentation by Ingredient:

- Chemical: Synthetic formulations targeting specific conditions like acne and pigmentation.

- Natural: Plant-derived ingredients such as herbal extracts and essential oils favored by clean-label consumers.

Segmentation by Gender:

- Male: Products tailored for men’s skin types, including grooming aids and sun protection.

- Female: Broad category covering anti-aging, hydration, and beauty-enhancing skincare.

- Unisex: Gender-neutral formulations suitable for both men and women.

Segmentation by Distribution Channel:

- Supermarkets and Hypermarkets: Mass-market accessibility with wide product variety.

- Beauty Parlours and Salons: Premium and professional-grade skincare treatments.

- Multi‑Branded Retail Stores: Department and cosmetic chains offering multiple brands.

- Online: E‑commerce platforms for convenience and direct-to-consumer offerings.

- Exclusive Retail Stores: Single-brand boutiques focusing on upscale customer experience.

- Others: Direct sales, pharmacies, specialty outlets.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

REGIONAL INSIGHTS

There's a growing awareness about the negative impacts of UV exposure, pollution, and our lifestyle choices, which is really pushing people to embrace preventive skincare. A recent poll from 2024 found that 46% of women and 18% of men in the U.S. are concerned about wrinkles, showing a clear demand for anti-aging products. Consumers are leaning heavily towards natural options that are free from chemicals, parabens, and cruelty, which has led major brands to roll out clean-beauty lines featuring botanical and herbal ingredients. This movement, driven by a heightened sense of environmental and health awareness, is directing research and development investments towards safer alternatives. As a result, we're seeing a steady growth in market share and an uptick in premium natural skincare products.

RECENT DEVELOPMENTS & NEWS

On the tech front, rapid advancements are reshaping how products are developed in the skincare sector. We're witnessing innovations like biotech-enhanced delivery systems, DNA-based ingredients, and solutions that are sensitive to the microbiome. For example, Pond’s Skin Institute launched a microbiome analyzer in July 2024 that can provide a personalized skincare regimen in just 60 minutes, marking a significant step forward in in-store customization. Plus, AI-driven virtual diagnostics and tailored formulations are becoming quite common. This kind of technological edge not only supports higher price points but also fosters stronger consumer loyalty, fueling premiumization and speeding up market growth.

KEY PLAYERS

- L'Oréal S.A.

- Unilever plc

- Procter & Gamble Company

- Johnson & Johnson

- Beiersdorf AG

- Shiseido Company Limited

- Mary Kay Inc.

- Avon Products (Natura & Co)

- Colgate‑Palmolive Company

- Revlon, Inc.

- The Estée Lauder Companies Inc.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1353&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Script

- App