Middle East and Africa Digital Payment Market Opportunities | Emerging Trends and Strategic Forecast 2025 - 2032

Detailed Analysis of Executive Summary Middle East and Africa Digital Payment Market Size and Share

Detailed Analysis of Executive Summary Middle East and Africa Digital Payment Market Size and Share

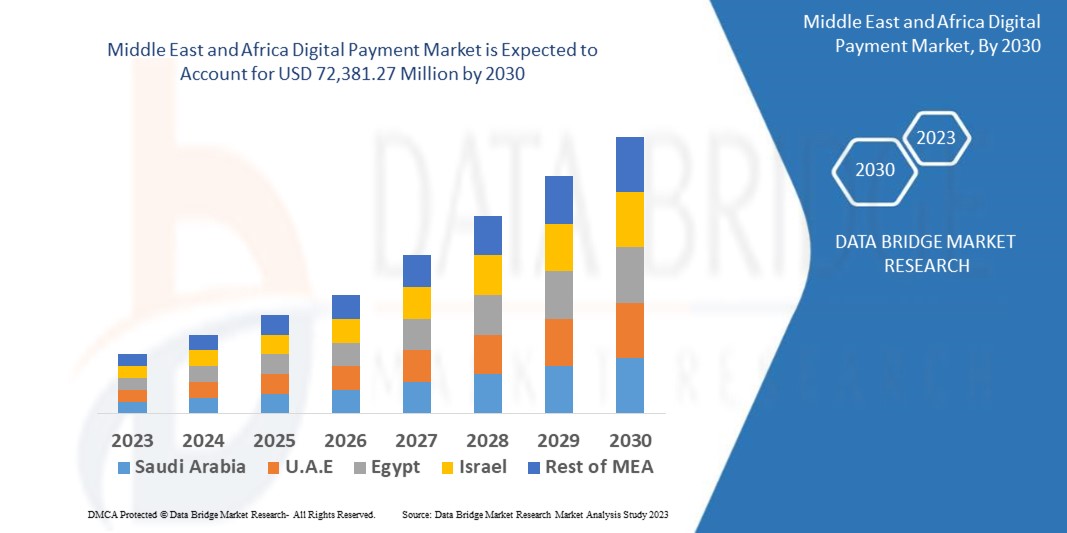

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 72,381.27 million by 2030, which is USD 19,652.35 million in 2022, at a CAGR of 17.70% during the forecast period.

This Middle East and Africa Digital Payment Market report serves you with the bigger picture of the marketplace as it studies market and the industry by considering several aspects. This market report gives an absolute background analysis of the industry along with an assessment of the parental market. To achieve sustainable growth in the market, businesses must be well-versed with the specific and most relevant product and market information in the Middle East and Africa Digital Payment Market The resources used for collecting the data and information that is included in this report are very trustworthy and range from journals, company websites, and white papers etc.

Being professional and comprehensive, this Middle East and Africa Digital Payment Market report focuses on primary and secondary drivers, market share, leading segments, possible sales volume, and geographical analysis. This market report also analyzes the market status, market share, current trends, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors. The Middle East and Africa Digital Payment Market report clearly explains what market definition, classifications, applications, engagements and market trends are for the Middle East and Africa Digital Payment Market industry. This market report provides explanation about the detailed market analysis with inputs from industry experts. The Middle East and Africa Digital Payment Market report presents data on patterns and improvements, and target business sectors and materials, limits and advancements.

Take a deep dive into the current and future state of the Middle East and Africa Digital Payment Market. Access the report:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market

Middle East and Africa Digital Payment Market Data Summary

**Segments**

- By Component: Solutions, Services.

- By Deployment Type: On-Premises, Cloud.

- By Organization Size: Small and Medium-Sized Enterprises (SMEs), Large Enterprises.

- By Vertical: Banking, Financial Services, and Insurance (BFSI), Retail and eCommerce, Telecommunications and Information Technology (IT), Healthcare, Government, Others.

In the Middle East and Africa region, the digital payment market is witnessing significant growth due to the increasing adoption of digital payment solutions across various industries. The market segmentation based on components includes solutions and services. Solutions segment is expected to dominate the market as businesses are increasingly investing in advanced payment technologies to offer enhanced customer experiences. On the other hand, the services segment is also expected to witness substantial growth as the demand for professional services such as consulting, integration, and support services rises.

Deployment type is another crucial segment, with on-premises and cloud being the two primary categories. Cloud-based deployment is anticipated to exhibit considerable growth owing to its scalability, cost-effectiveness, and ease of implementation. Additionally, the organization size segment includes small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting digital payment solutions to streamline their financial processes and cater to the evolving customer demands.

Vertical segment plays a vital role in the Middle East and Africa digital payment market, with key industries such as banking, financial services, and insurance (BFSI) leading the adoption. The retail and eCommerce sector is also experiencing significant growth as online shopping becomes more popular in the region. Moreover, the telecommunications and information technology (IT) industry is leveraging digital payment solutions to enhance operational efficiency and customer satisfaction. Other sectors such as healthcare and government are also expected to contribute to the market growth.

**Market Players**

- Mastercard

- Visa Inc.

- PayPal Holdings, Inc.

- Apple Inc.

- Fiserv, Inc.

- ACI Worldwide, Inc.

- FIS

- Square, Inc.

- Intuit Inc.

- Alipay

These market players are actively involved in mergers, acquisitions, partnerships, and product innovations to strengthen their market presence and gain a competitive edge. Collaborations between key players and local businesses are expected to drive market growth further by expanding the reach of digital payment solutions in the Middle East and Africa region.

The Middle East and Africa region present a promising landscape for the digital payment market with a multitude of opportunities across various industry verticals. One noteworthy aspect that could further drive market growth is the increasing focus on enhancing cybersecurity measures to safeguard digital payment transactions. As cyber threats continue to evolve, businesses and consumers alike are prioritizing data security and privacy, leading to a surge in demand for advanced security solutions within digital payment platforms. This heightened emphasis on cybersecurity could propel the adoption of secure digital payment technologies and solutions in the region, thereby bolstering market expansion.

Moreover, the regulatory environment in the Middle East and Africa plays a pivotal role in shaping the digital payment ecosystem. Regulatory bodies are introducing guidelines and frameworks to ensure the security, interoperability, and efficiency of digital payment systems. Compliance with these regulations is essential for market players to operate seamlessly and gain customer trust. Therefore, companies offering digital payment solutions need to stay abreast of evolving regulatory requirements and tailor their offerings to align with the region's specific regulatory landscape.

In terms of market dynamics, strategic partnerships and collaborations among industry participants are expected to drive innovation and market penetration. By joining forces with fintech startups, local businesses, and technology providers, established players can leverage their combined expertise to introduce tailored digital payment solutions that cater to the unique needs of the Middle East and Africa market. Additionally, market players are likely to focus on expanding their product portfolios to offer a diverse range of payment solutions, including mobile payments, contactless payments, and peer-to-peer transfers, to cater to the evolving preferences of consumers and businesses in the region.

Furthermore, the increasing smartphone penetration and internet connectivity in the Middle East and Africa present a significant growth opportunity for the digital payment market. With more consumers accessing digital payment platforms via their mobile devices, there is a growing need for seamless, user-friendly payment experiences that can be accessed anytime, anywhere. Market players that invest in developing intuitive mobile payment applications and platforms are poised to capitalize on this trend and gain a competitive advantage in the market.

Overall, the Middle East and Africa digital payment market hold immense potential for expansion and innovation, driven by factors such as increasing digitalization, evolving consumer preferences, regulatory developments, and strategic collaborations among market players. As the region continues to embrace digital transformation, companies that can adapt to the changing landscape and deliver secure, seamless, and convenient digital payment solutions are likely to thrive and reshape the future of payments in the Middle East and Africa.The Middle East and Africa region present a dynamic landscape for the digital payment market, characterized by a growing adoption of digital payment solutions across various industries. In this region, key market segments such as solutions, services, deployment types, organization sizes, and verticals play a crucial role in shaping the market dynamics. The adoption of advanced payment technologies by businesses to enhance customer experiences is driving the growth of the solutions segment, while the services segment is witnessing significant demand for professional services like consulting and integration. Cloud-based deployment is gaining traction due to its scalability and cost-effectiveness, particularly favored by SMEs looking to streamline financial processes.

Across different verticals, industries such as the BFSI sector, retail and eCommerce, telecommunications, and healthcare are driving the adoption of digital payment solutions in the Middle East and Africa. With the rising trend of online shopping and mobile payments, the retail sector is experiencing substantial growth, while the BFSI industry leads in adopting innovative payment technologies. Collaboration between market players and local businesses, along with strategic partnerships and product innovations, are key drivers shaping the competitive landscape in this region, propelling market growth further.

Additionally, the focus on enhancing cybersecurity measures to safeguard digital transactions is a noteworthy aspect that could drive market expansion. The increasing emphasis on data security and privacy is pushing for the adoption of secure digital payment technologies, thus creating opportunities for market players to innovate and differentiate their offerings. Moreover, regulatory guidelines and frameworks are shaping the digital payment ecosystem in the Middle East and Africa, emphasizing the importance of compliance for market players to gain customer trust and operate seamlessly.

Furthermore, the increasing smartphone penetration and internet connectivity in the region present significant growth opportunities for the digital payment market, as consumers seek user-friendly payment experiences accessible through mobile devices. Market players that invest in developing intuitive mobile payment applications and platforms are poised to capitalize on this trend and gain a competitive edge. Overall, the evolving market dynamics, regulatory landscape, technological advancements, and consumer preferences in the Middle East and Africa offer a promising outlook for the digital payment market, stimulating innovation, expansion, and strategic collaborations among industry participants.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market/companies

Middle East and Africa Digital Payment Market Overview: Strategic Questions for Analysis

- What is the size of the global Middle East and Africa Digital Payment Market industry this year?

- What rate of growth is forecasted for the next decade for Middle East and Africa Digital Payment Market?

- What are the key divisions of the Middle East and Africa Digital Payment Market?

- Which organizations have the strongest presence in Middle East and Africa Digital Payment Market?

- Which markets are the focus of the geographic analysis for Middle East and Africa Digital Payment Market ?

- What companies are featured in the competitive landscape for Middle East and Africa Digital Payment Market?

Browse More Reports:

Global Medical Sensors Market

Global Medication Delivery Systems Market

Global Meniere’s Disease Treatment Market

Global Mesothelioma Treatment Market

Global Metallized Paper Market

Global Methyl Acrylate Market

Global Micro Server Integrated Circuit (IC) Market

Global Microbial Identification Market

Global Micronized Graphite Powder Market

Global Millimeter Wave Technology Market

Global Mining Lubricants Market

Global Mobile Health Platforms Market

Global Modified Atmosphere Packaging Market

Global Modified Starch Market

Global Mojito Syrup Market

Global Surgical, Medical, and Hospital Instruments Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Seo

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Business & Money