-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Developers

Europe Usage-Based Insurance Market Revolution | Transformative Growth and Industry Forecast 2025 - 2032

Executive Summary Europe Usage-Based Insurance Market Research: Share and Size Intelligence

Executive Summary Europe Usage-Based Insurance Market Research: Share and Size Intelligence

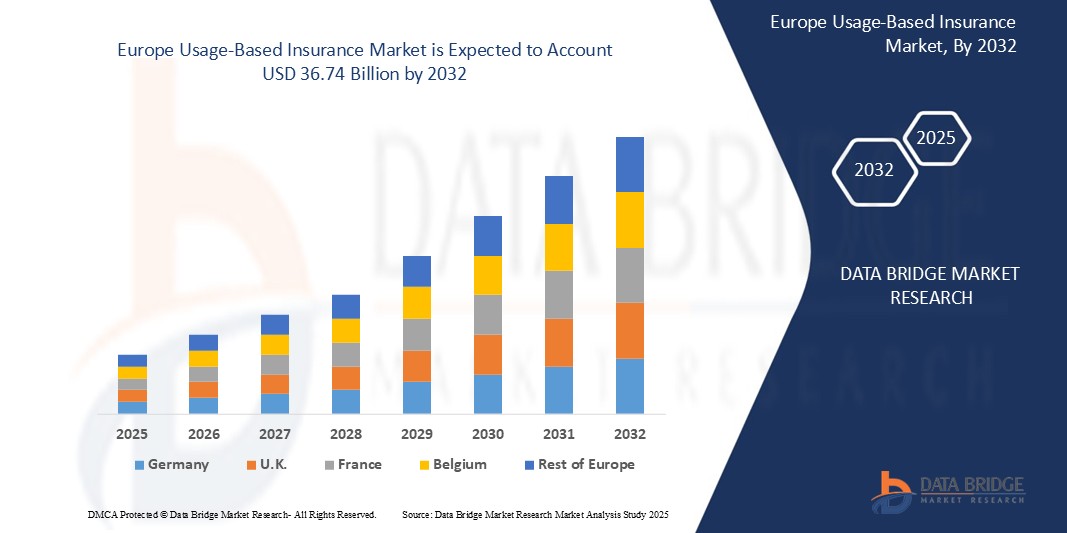

The Europe Usage-Based Insurance Market size was valued at USD 10.01 billion in 2024 and is expected to reach USD 36.74 billion by 2032, at a CAGR of 17.65% during the forecast period

Market research studies stated in this Europe Usage-Based Insurance Marketreport are very thoughtful for the businesses which assist them with the better decision making and develop better strategies about production, marketing, sales and promotion. This Europe Usage-Based Insurance Market report brings together comprehensive industry analysis with exact estimates and forecasts that offers complete research solutions with maximum industry clarity. The report includes fluctuations during the forecast period of 2018-2025 for the market. And to serve the clients best in the industry, a team of experts, skilled analysts, dynamic forecasters and knowledgeable researchers work meticulously while forming this report.

This Europe Usage-Based Insurance Market report is an ultimate source of information about the industry, important facts and figures, expert opinions, and the latest developments across the globe. The report studies various inhibitors as well as motivators of the market in both quantitative and qualitative manner so that users can have perfect information. The base year for calculation in the Europe Usage-Based Insurance Market report is considered as 2017 while the historic year is 2016 which will tell you how the Europe Usage-Based Insurance Market is going to perform in the forecast years. The Europe Usage-Based Insurance Market report introduces the basics of industry such as market definitions, classifications, applications and industry chain overview, after which it covers industry policies and plans, product specifications, manufacturing processes, cost structures and so on.

Find out what’s next for the Europe Usage-Based Insurance Market with exclusive insights and opportunities. Download full report:

https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market

Europe Usage-Based Insurance Market Dynamics

**Segments**

- **Application**: The Europe usage-based insurance market can be segmented based on applications such as automotive, biometrics, mobile applications, and others. The automotive segment is the most dominant due to the widespread adoption of connected car technologies and telematics systems that enable insurers to track driving behavior and assess risk effectively.

- **Insurance Type**: This segment includes pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD) insurance types. PAYD insurance is based on the number of miles driven, PHYD is based on driving behavior such as speed and braking, while MHYD combines both mileage and behavior to determine insurance premiums.

- **Vehicle Type**: The Europe market can also be segmented by vehicle types, including passenger vehicles, commercial vehicles, and others. Passenger vehicles account for the largest share as they are more commonly equipped with telematics and connected car technologies compared to commercial vehicles.

- **Distribution Channel**: This segment includes direct sales and intermediaries such as agents and brokers. The direct sales channel is gaining popularity as insurers leverage digital platforms and mobile applications to offer usage-based insurance directly to customers.

**Market Players**

- **Allianz Group**: As one of the leading insurance providers in Europe, Allianz Group offers usage-based insurance products that utilize telematics technology to assess risk and provide personalized pricing to policyholders.

- **Progressive Corporation**: With its Snapshot program, Progressive Corporation is a key player in the Europe usage-based insurance market, offering discounts to policyholders based on their driving behavior monitored through telematics devices.

- **Generali Group**: Generali Group is actively involved in the usage-based insurance market in Europe, leveraging telematics data to offer customized insurance solutions and promote safe driving practices among customers.

- **AXA**: AXA is a prominent player in the Europe market, offering usage-based insurance options that enable policyholders to track their driving habits and adjust their premiums based on their behavior behind the wheel.

The Europe usage-based insurance market is witnessing significant growth due to the increasing adoption of IoT devices, advancements in telematics technology, and a shift towards personalized insurance solutions. Insurers are increasingly focusing on innovative pricing models and data analytics to better assess risk and provide tailored insurance products to customers. With the evolving regulatory landscape and changing consumer preferences, market players are expected to continue investing in technology and partnerships to drive growth and competitiveness.

The Europe usage-based insurance market is poised for continued expansion and transformation as key players leverage innovative technologies and data analytics to stay competitive in the evolving landscape. One notable trend reshaping the market is the increasing integration of Internet of Things (IoT) devices in vehicles, facilitating real-time data collection on driving behavior and enabling insurers to offer more personalized insurance solutions. This shift towards data-driven decision-making is fostering a more customer-centric approach, as insurers can better understand individual risk profiles and tailor coverage accordingly.

In addition to IoT integration, advancements in telematics technology are playing a crucial role in driving the growth of usage-based insurance in Europe. Telematics systems enable insurers to gather detailed insights into driving habits, such as speed, acceleration, and braking patterns, allowing for a more accurate assessment of risk. By utilizing telematics data, insurers can reward safe driving behavior with lower premiums, incentivizing policyholders to adopt better driving practices and ultimately contribute to improved road safety across the region.

Furthermore, the market is witnessing a surge in demand for customized insurance solutions that cater to specific needs and preferences of customers. Usage-based insurance types such as pay-as-you-drive and pay-how-you-drive are gaining traction as they offer flexibility and transparency in pricing, aligning more closely with individual usage patterns and driving behaviors. This personalized approach not only enhances customer satisfaction but also fosters long-term customer loyalty, driving sustainable growth for insurers in the fiercely competitive market landscape.

Moreover, the regulatory environment in Europe is also playing a significant role in shaping the future of usage-based insurance. Insurers are required to comply with stringent data privacy regulations such as GDPR, which govern the collection and handling of telematics data to protect customers' personal information. Adhering to regulatory standards while harnessing the power of data analytics poses a challenge for market players, but it also presents opportunities to build trust with customers by demonstrating responsible data stewardship practices.

Overall, the Europe usage-based insurance market is on a trajectory of continued expansion and innovation driven by technological advancements, changing consumer preferences, and regulatory dynamics. As insurers strive to differentiate themselves in a crowded marketplace, investing in robust data analytics capabilities, strategic partnerships, and customer-centric solutions will be paramount to sustain growth and stay ahead of the competition in this dynamic and evolving landscape.The Europe usage-based insurance market is experiencing a paradigm shift driven by technological advancements, changing consumer behaviors, and regulatory frameworks. One of the key trends reshaping the market landscape is the increasing integration of IoT devices in vehicles, allowing insurers to collect real-time data on driving habits. This data collection enables insurers to offer more personalized insurance solutions tailored to individual risk profiles, enhancing customer satisfaction and loyalty. Moreover, advancements in telematics technology are playing a pivotal role in fueling the growth of usage-based insurance by providing detailed insights into driving behavior, enabling insurers to incentivize safe driving practices with lower premiums. The market is witnessing a surge in demand for customized insurance solutions like pay-as-you-drive and pay-how-you-drive, aligning pricing more closely with individual usage patterns and driving behaviors.

Furthermore, the regulatory environment in Europe, particularly data privacy regulations such as GDPR, is influencing how insurers collect and handle telematics data. Compliance with stringent data protection regulations presents challenges but also opportunities for insurers to build trust with customers through responsible data management practices, demonstrating their commitment to safeguarding personal information. As the market continues to evolve, insurers are focusing on innovative pricing models, data analytics, and strategic partnerships to differentiate themselves in a competitive landscape. Customer-centric solutions that offer transparency, flexibility, and tailored coverage options are becoming increasingly crucial for insurers to drive sustainable growth and remain competitive in the dynamically changing market environment.

Overall, the Europe usage-based insurance market is poised for continued expansion and transformation as market players adapt to technological advancements, changing consumer preferences, and regulatory requirements. Investing in robust data analytics capabilities, forging strategic partnerships, and providing personalized insurance solutions will be essential for insurers to navigate the evolving landscape successfully. By leveraging IoT devices, telematics technology, and customer-centric approaches, insurers can enhance risk assessment accuracy, promote safer driving behaviors, and build lasting relationships with policyholders in a market that prioritizes innovation, customization, and regulatory compliance.

Track the company’s evolving market share

https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market/companies

Master List of Market Research Questions – Europe Usage-Based Insurance Market Focus

- What is the scope of the global Europe Usage-Based Insurance Market?

- What is the anticipated pace of growth for the Europe Usage-Based Insurance Market sector?

- What Europe Usage-Based Insurance Market segments are most profitable?

- Who are the powerhouses in the global Europe Usage-Based Insurance Market?

- What are the top-performing countries in the dataset for the Europe Usage-Based Insurance Market?

- What firms are ranked highest in revenue in Europe Usage-Based Insurance Market?

Browse More Reports:

Global Vegetable Shortening Market

Global Vehicle Lightweighting Market

Global Vendor Neutral Archive (VNA) Market

Global Veterinary Calcium Supplement Market

Global Veterinary Dental Equipment Market

Global Veterinary Endoscopy Market

Global Video Intercom Devices Market

Global Video Measuring System Market

Global Video on Demand (VOD) Service Market

Global Virtualization Security Market

Global Wafer Dicing Saws Market

Global Water Bath Market

Global Water Hardness Test Strip Market

Global Wearable Computing Market

Global Web Performance Market

Global Life Sciences Commercialization Vendor Platform Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

- Seo

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Business & Money