Global Neurology Devices Market Analysis: Size, Share & Regional Insights 2024–2033

MARKET OVERVIEW

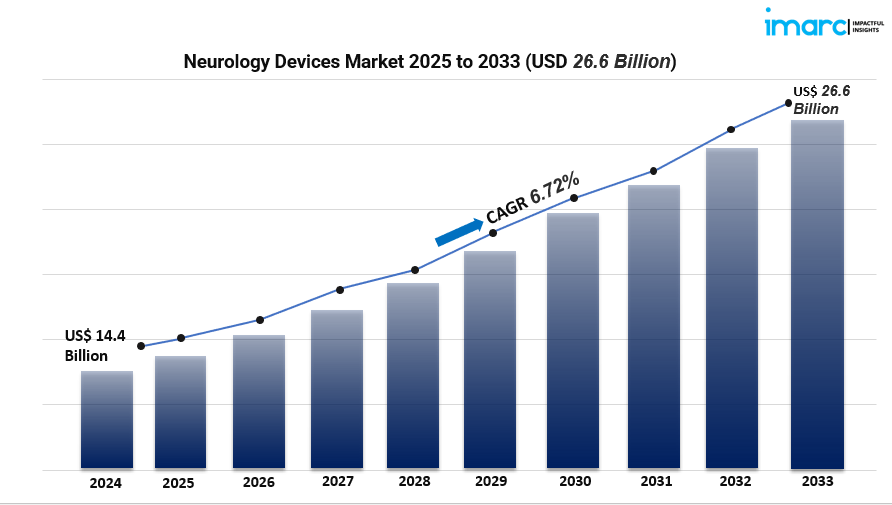

The global Neurology Devices Market reached a valuation of USD 14.4 billion in 2024 and is poised to hit USD 26.6 billion by 2033, growing at a robust 6.72% CAGR. This expansion is driven by a rising burden of neurological disorders (such as epilepsy, Alzheimer’s, and strokes), rapid technological innovation in medical devices, increasing government support, and an aged global population fueling demand for advanced neurocare.

STUDY ASSUMPTION YEARS

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

NEUROLOGY DEVICES MARKET KEY TAKEAWAYS

- Market size & growth: Valued at USD 14.4 billion in 2024; forecast to reach USD 26.6 billion by 2033, growing at 6.72% CAGR.

- Regional dominance: North America leads, backed by advanced healthcare infrastructure.

- Product segmentation: Neurostimulation devices represent the largest product share.

- End‑user segmentation: Hospitals dominate adoption over ambulatory surgery centers and neurology clinics.

- Drivers fueling growth: Technological innovation, government initiatives, and expanding healthcare facilities.

- Opportunities and challenges: Regulatory complexities exist, but regenerative medicine and restorative therapies present strong opportunities.

- Competitive field: Leading players include Abbott, Medtronic, Boston Scientific, and others shaping innovation.

MARKET GROWTH FACTORS

1. Prevalence of Neurological Disorders & Aging Population

Neurological conditions such as epilepsy, Alzheimer’s, and cerebrovascular diseases are on the rise, leading to a growing need for precise diagnostic and therapeutic tools. According to WHO estimates, over 206 million people were living with diabetic neuropathy in 2021, and by 2050, the number of individuals aged 80 and older could soar to 426 million. As older adults are more vulnerable to neurodegenerative disorders, the demand for neurology devices is becoming increasingly urgent. These devices—especially neurostimulation and neurosurgery tools—play a vital role in essential outcomes like neural imaging, brain activity monitoring, and surgical procedures, all of which significantly enhance patient care and contribute to market growth.

2. Technological Advancements in Device Innovation

The rapid advancements in neurology devices are transforming treatment approaches. Companies are now incorporating telehealth and digital monitoring into their device designs. For instance, Abbott’s revamped NeuroSphere™ myPath™ app improves collaboration between clinicians and patients remotely. Moreover, in January 2024, the FDA gave the green light to Medtronic’s Percept RC deep brain stimulation system featuring BrainSense, which allows for more tailored interventions for movement disorders. These advancements in software, AI-driven platforms, and implantable sensors are not only improving clinical outcomes but also encouraging patient adherence, which in turn is accelerating device adoption and expanding the market.

3. Supportive Policies & Healthcare Infrastructure Expansion

Supportive government policies that promote R&D in neurology devices and enhance medical infrastructure are crucial. Many areas, particularly in North America, are making significant investments in upgrading healthcare facilities and advancing neurologic research. The market's growth is further bolstered by increased funding for regenerative medicine and neuro-restorative therapies. While regulatory bodies can create hurdles, they are also working to streamline the approval processes for innovative devices. This collaboration between policy and infrastructure is improving access to neurology technologies, fostering adoption, and enabling further innovation in the industry.

Request for a sample copy of this report: https://www.imarcgroup.com/neurology-devices-market/requestsample

MARKET SEGMENTATION

Breakup by Product

- Neurostimulation Devices: Devices offering electrical stimulation to treat neurological conditions.

- Neurosurgery Devices: Tools used during neurosurgical procedures.

- Interventional Neurology Devices: Equipment for minimally invasive neurological interventions.

- Cerebrospinal Fluid Management Devices: Devices for CSF regulation and drainage.

- Others: Additional neurology-related devices not listed above.

Breakup by End User

- Hospitals: Primary care providers and adopters of neurology devices.

- Ambulatory Surgery Centers: Facilities offering outpatient neuroprocedures.

- Neurology Clinics: Specialized centers for neurological diagnostic and therapeutic care.

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

REGIONAL INSIGHTS

North America is at the forefront of the neurology devices market, thanks to its top-notch healthcare infrastructure, a strong preference for minimally invasive procedures, and supportive regulatory environments. The high prevalence of neurological diseases, combined with tech-savvy healthcare providers, is driving up demand. This unique blend positions North America as the region with the greatest potential for growth.

RECENT DEVELOPMENTS & NEWS

IMARC points out several exciting innovations in neurology devices. For instance, in January 2024, the FDA gave the green light to Medtronic’s Percept RC DBS system featuring BrainSense, which allows for real-time neural data to tailor treatments. Healthcare providers are also embracing remote monitoring systems like Abbott’s NeuroSphere™ app (launched in April 2022), which improves patient follow-up. The growing availability of AI-integrated imaging tools is making it easier to detect early-stage strokes and traumatic brain injuries. These trends highlight a significant shift towards high-precision diagnostics, patient-focused remote care, and personalized neuromodulation therapies in the industry.

KEY PLAYERS

- Abbott Laboratories

- B. Braun

- Boston Scientific Corporation

- Integra LifeSciences

- LivaNova PLC

- Medtronic plc

- Nihon Kohden Corporation

- Penumbra Inc.

- Stryker Corporation

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=6191&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Script

- App