Transfection Technologies Market 2025–2033: Key Growth Drivers & Trends

Market Overview

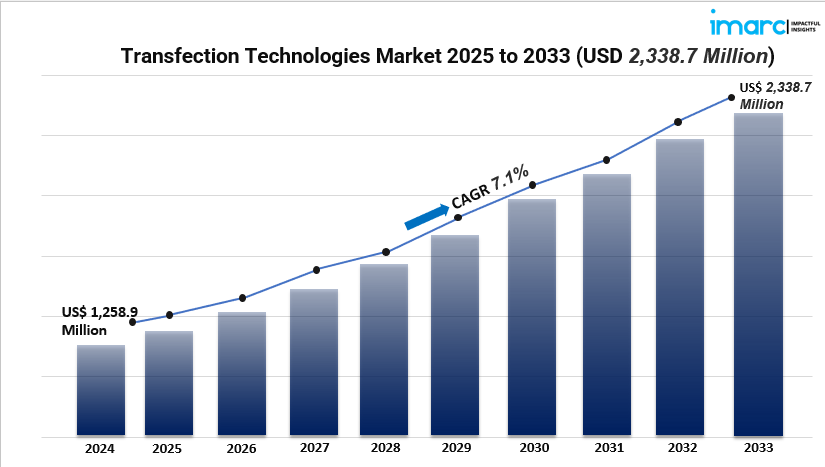

The global transfection technologies market is projected to grow from USD 1,258.9 million in 2024 to USD 2,338.7 million by 2033, at a CAGR of 7.1%. This expansion is propelled by ongoing breakthroughs in gene therapy, regenerative medicine, CAR‑T therapies, biologics, nucleic acid vaccines, and extensive collaborations between academia and biotech—creating robust demand for scalable, effective gene-delivery methods .

Study Assumption Years

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

Transfection Technologies Market Key Takeaways

- Market Size & Growth: Valued at USD 1,258.9 M in 2024, rising to USD 2,338.7 M by 2033 at a 7.1% CAGR .

- Regional Leader: North America leads with 39.3% market share, thanks to strong biotech and gov’t funding .

- Product Insights: Reagents dominate (51.5%) due to ease of use and scalability.

- Top Application: Biomedical research holds a 41.5% share, driven by molecular biology and functional genomics .

- Leading Method: Electroporation (20.9%) is preferred for tough-to-transfect and primary cells .

- Technology Preference: Biochemical-based transfection (53.5%) leads due to versatility and cost-efficiency .

- End Users: Research centers and academic institutes are primary adopters, closely followed by pharma/biotech companies .

Market Growth Factors

1. Technological Advancements in Non‑Viral Delivery

Innovations in non‑viral transfection—especially electroporation systems, lipid formulations, and nanoparticle carriers—are significantly enhancing delivery efficiency while minimizing cytotoxicity. These platforms are essential for gene editing, CAR‑T, and vaccine development. Electroporation now accounts for ~20.9% of market share, favored for its adaptability in both in vivo and in vitro settings . Concurrently, biochemical reagents (53.5%) like lipid-based agents offer scalable and safe solutions for a wide range of lab workflows. Continuous R&D is rapidly improving reagent performance, supporting mass adoption in both academic and industrial labs .

2. Expanding Cell Therapy & Gene Medicine Applications

The boom in cell therapies, projected to grow at a 14.51% CAGR post-2024 (USD 15.68 B market), is driving surging demand for precise gene delivery systems . Therapies such as CAR‑T and stem-cell engineering rely heavily on scaling non-viral transfection methods like electroporation and lipid nanoparticles. These technologies are key to producing clinical‑grade, genetically modified cells with high viability and efficiency. As regulatory approvals increase and production shifts from R&D to clinical manufacturing, transfection systems play a pivotal role, prompting ongoing investments from biotech firms .

3. Rising Biotech Investment & Genomics-focused Research

North America’s stronghold (39.3% share) stems from substantial biotech funding, robust research infrastructure, and government support . For example, the U.S. genomics market reached USD 13.1 B in 2024. Such investment fuels demand for advanced transfection tools—especially for gene therapies and biologics production. Collaborative efforts among universities, CROs, and industry players are fast-tracking innovations in delivery methods. This environment encourages suppliers to enhance global reach and integrate AI-enhanced platforms like the AI@HHMI initiative ($500 M over 10 years), further accelerating market development.

Request for a sample copy of this report: https://www.imarcgroup.com/transfection-technologies-market/requestsample

Market Segmentation

By Product Type:

- Reagent: Chemical/lipid formulations enabling high‑efficiency gene delivery.

- Instrument: Physical devices (e.g., electroporators, nucleofectors) for precise transfection.

- Others: Additional transfection tools and consumables.

By Application:

- Therapeutic Delivery: Gene-based drug and therapy development.

- Bio‑Medical Research: Fundamental studies in cell mechanisms and genomics.

- Protein Production: Recombinant protein and biologics manufacturing.

- Others: Additional research and clinical applications.

By Transfection Method:

- Lipofection

- Electroporation

- Nucleofection

- Cotransfection

- Cationic Lipid Transfection

- In‑Vivo Transfection

- Others

By Technology:

- Physical Transfection

- Biochemical Based Transfection

- Viral‑Vector Based Transfection

By End‑User:

- Research Centers and Academic Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America leads the market with a 39.3% share, thanks to its advanced genomics infrastructure (USD 13.1 B in 2024), strong public-private funding, and prominent biotech hubs. The U.S. gene therapy market is projected to reach USD 3,697.8 M by 2033 at a 12.1% CAGR, driving demand for novel transfection tools. Universities, CROs, and startups are investing heavily in gene-modified therapies, solidifying the region's dominance .

Recent Developments & News

Recent advancements have centered on enhancing non-viral delivery techniques. In December 2024, CellFE launched its Infinity MTx platform across major pharma and biotech firms, showing promise in non-electroporative cell therapy uses. October 2024 saw Opencell partner with Adva Biotechnology to integrate Softporation with ADVA X3®, enabling automated cell transfection workflows. In August 2024, Merck acquired Mirus Bio (TransIT-VirusGEN reagent) for USD 600 M, expanding its viral vector lineup. And July 2024 brought STEMCELL Technologies’ commercial launch of the CellPore Transfection System, marking a new step in cell engineering capabilities .

Key Players

- Agilent Technologies Inc.

- Altogen Biosystems

- Amsbio

- Bio-RAD Laboratories Inc.

- Lonza Group AG

- Maxcyte Inc.

- Mirus Bio LLC

- Promega Corporation

- QIAGEN N.V.

- Sartorius AG

- SignaGen Laboratories

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2188&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Script

- App